Editor’s Note: Over the next few weeks on CPO Rising, we’re publishing some “best of” 2020 articles as we reflect on the year and prepare for the new year ahead.

Every business function faces a rash of challenges relative to its specific operational purpose. For decades, the AP unit resided firmly in the back office, mired in paper-based, manual processes, which limited the value that the function could offer. In 2020, the COVID-19 pandemic has shaken many businesses to their core, replacing traditional business structures and protocols (collaboration, in-person processes and coordination, regular team meetings, etc.) with an entirely new paradigm. Accounts payable face a series of challenges that must be overcome to continue its strategic path forward while also striving to ensure continuity, and pave the path to recovery in these uncertain times.

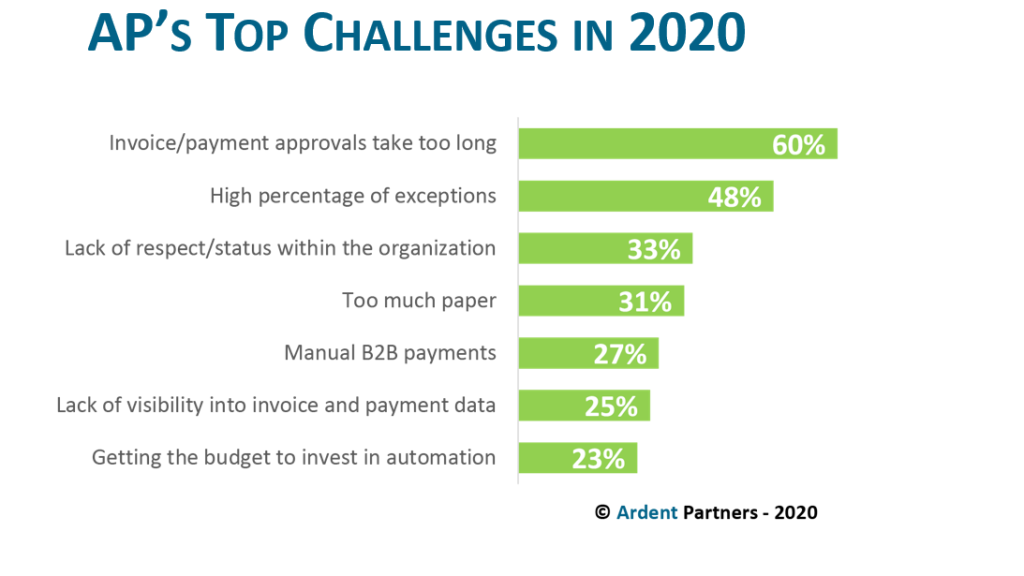

Over the years, AP has faced a series of challenges that are directly linked to a reliance on paper-based processes. As AP leaders navigate the current state of business, a majority (60%) still face lengthy invoice and payment approval times (see chart below from Ardent’s ‘State of ePayables 2020’ market research report). While this has always been a “top five” issue for the AP group, this is the first instance in many years that approval process deficiencies rank as the top challenge. However, there is a very valid (and current) reason for this challenge: as social distance and shelter-in-place advisories rock both personal and business perspectives, the inability to perform in-person procedures has negatively impacted those AP functions without full automation in place.

A recurring theme in the world of AP is the havoc wrought by invoice exceptions; today, 48% of AP departments rank their high percentage of invoice exceptions as a major problem (see chart above from Ardent’s ‘State of ePayables 2020’ market research report). Like a pebble in a hiking boot or the slow leak in a tire, invoice exceptions are annoying. And unfortunately for AP they are, given their high number, acceptable for many in the invoice-processing operation. But to be clear, invoice exceptions are a primary cause of higher processing costs and times. If an exception occurs due to information discrepancy, such as a lack of a purchase order (Ardent’s research has found that 73% of all invoice exceptions are linked to a discrepancy in invoice information, the top reason for these exceptions), the entire process grinds to a halt. Accounts payable is forced to resolve the exception, which can disrupt the normal approval workflow and payment timing. While necessary, the time spent managing exceptions is of little strategic value. It also pulls the AP team away from working on more strategic activities such as spend management and fraud prevention.

A recurring theme in the world of AP is the havoc wrought by invoice exceptions; today, 48% of AP departments rank their high percentage of invoice exceptions as a major problem (see chart above from Ardent’s ‘State of ePayables 2020’ market research report). Like a pebble in a hiking boot or the slow leak in a tire, invoice exceptions are annoying. And unfortunately for AP they are, given their high number, acceptable for many in the invoice-processing operation. But to be clear, invoice exceptions are a primary cause of higher processing costs and times. If an exception occurs due to information discrepancy, such as a lack of a purchase order (Ardent’s research has found that 73% of all invoice exceptions are linked to a discrepancy in invoice information, the top reason for these exceptions), the entire process grinds to a halt. Accounts payable is forced to resolve the exception, which can disrupt the normal approval workflow and payment timing. While necessary, the time spent managing exceptions is of little strategic value. It also pulls the AP team away from working on more strategic activities such as spend management and fraud prevention.

One-third (33%) of all AP groups are still challenged by other stakeholders’ poor view of the function. While many of AP’s other core hurdles revolve around the simple paper problem—more paper and more manual- based tasks translates into longer invoice approval cycle times and longer payment processing times (27%), which can trigger unhappy suppliers, missed discounts, and late payment penalties. Additionally, the lack of overall visibility into invoice/payment data (25%), due to the sheer volume of paper invoices, can result in missed opportunities like optimal cash management.

Nearly all of the challenges discussed above have a variety of solutions available to the AP function. However, there is one solution that provides the strongest range of benefits and value to AP’s journey: automation.

RELATED RESEARCH

Tagged in: AP Automation, Bob Cohen, ePayables, ePayables 2020, ePayments, Innovation, Technology