Editor’s Note: Today’s article is a sample from Ardent Partners’ latest research report, CPO Rising 2018: The Age of Intelligence (click to register and download). Readers can access all of this year’s insights and analysis by clicking here.

Supply management, like other facets of business, is in the beginning stages of what has been dubbed the Fourth Industrial Revolution, or Industry 4.0. Innovations like 3-D printing, advanced (Big Data) analytics, artificial / augmented intelligence (AI), Blockchain distributed digital ledgers, connected devices (the “Industrial / Internet of Things”), deep learning, machine learning, natural language processing (NLP), robotic process automation (RPA), and virtual assistants dominate nearly every article and paper on business technology today (including this one).

While there are early applications of these technologies to supply management, the fact is that many sourcing, procurement, and accounts payable (AP) teams still struggle to adopt even basic process automation tools, let alone Industry 4.0 innovations. A quick look at data from 2012, based on survey responses from 267 Chief Procurement Officers (CPOs) and other supply management leaders, gives us some good reference points (and arguably, it gives business leaders a fair enough runway to show how they have progressed in the six years in between.

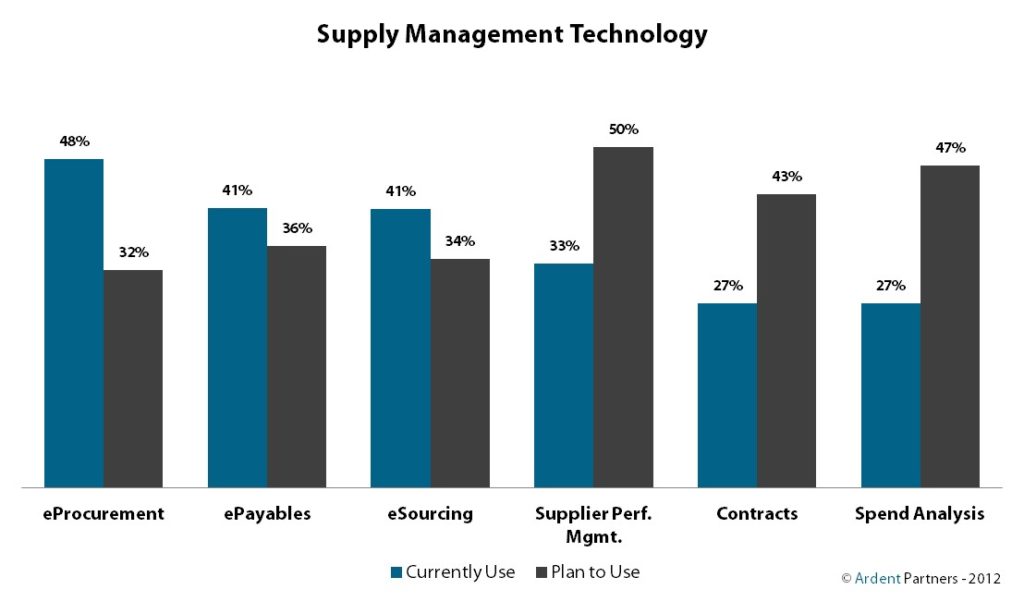

Figure 1 shows not only “current” (2012) adoption levels for a half-dozen digitized and or automated supply management technologies, but also planned adoption levels for these same technologies. Not pictured are supplier information management systems (20% current and 50% planned adoption) and supplier networks (19% current and 46% planned adoption). Generally speaking, there were high pluralities for technology adoption in 2012 (but no majority adoption for any one of them), which, combined with strong attitudes towards future planned technology adoption, left significant and widespread opportunities to further drive digital transformation “down range” (as they say in the military).

Figure 1: Actual and Planned Technology Adoption Levels — 2012

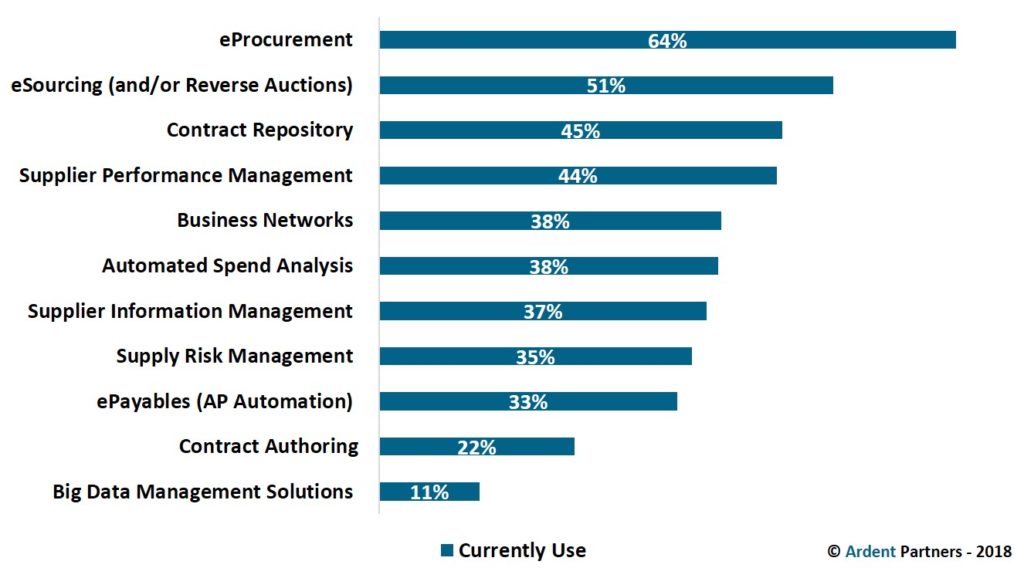

Fast forward to 2018. After six years of gradual, incremental economic growth, strong market performance, and generally healthy returns for business, it is interesting (if somewhat disappointing) to see mostly modest improvements in technology adoption. Based on the survey responses of 324 CPOs and other supply management leaders collected earlier this year, Figure 2 illustrates supply management’s long, slow march towards digital transformation.

Figure 2: Overall Source-to-Settle Technology Adoption — 2018

There are some upsides here. A few quick comparisons show that:

- 19% more organizations now use a business or supplier network

- 18% more organizations now deploy a digital contract repository

- 17% more organizations now have a supplier information management tool

- 16% more organizations now use eProcurement

- 11% more organizations now implement automated spend analysis

- 11% more organizations now conduct supplier performance management

- 10% more organizations now deploy eSourcing

- 8% fewer organizations now deploy ePayables (automated/electronic invoicing and payment)

Although supply management tools and applications are almost uniformly adopted in greater numbers today, the vast majority of these are still not deployed in a majority of sourcing, procurement, and AP teams. Only eProcurement (64%) and barely eSourcing (51%) are employed by a majority of organizations.

When survey respondents were analyzed according to key performance indicators and indexed into two maturity classes, even Best-in-Class organizations logged fairly disappointing adoption numbers for process digitization and automation tools. With the exception of eSourcing (71% of Best-in-Class CPOs reported their teams have it), the procurement pack leaders are themselves far (and in many cases, pretty far) from total digital transformation. That doesn’t mean that solution providers should halt their march towards smarter, more capable, and more user-friendly business solutions. It also doesn’t mean that CPOs and other supply management leaders cannot or should not plan for future technology adoption as they have in year’s past (they absolutely should). But it means that they still have significant ground to cover in the pursuit of total digital transformation.

Straight Shooting

For all the talk by innovative solution providers and progressive industry analysts (including this one) about the potential for Industry 4.0 technologies to transform supply management operations, the harsh reality (recall Figures 1 & 2) is that supply management teams still have a long hump ahead of them. Between budgetary and staff constraints, lack of executive support or mandate, organizational inertia, or other factors, technology adoption has been a slow and steady march, and looks to be that way moving forward. Thus, while there is substantial potential for Industry 4.0 technologies, organizations ought to prioritize process digitization, automation, standardization, and linkage before moving onto Industry 4.0.

RELATED ARTICLES

Get the CPO Rising 2018: The Age of Intelligence Report Today!

CPO Rising 2018: Created or Evolved? Defining the Intelligent Procurement Department

CPO Rising 2018: The Rise (and Rise) of Procurement Intelligence

Tagged in: Ardent Partners Research, Ardent Team, Chief Procurement Officer, CPO, Innovation, Source-to-Settle, Strategy, Technology, Transformation