The analyst team at Ardent Partners spends a lot of time discussing what we call the ePayables Framework. We discuss it at length in our market research studies. But maybe it makes sense to take a step back and provide an overview of the Framework and how AP professionals can utilize it when making investments in technology.

One of the most important steps for an AP department to make when starting a technology transformation project is to first understand the current state of the AP function. With that in mind, Ardent Partners developed its ePayables Framework to help AP and finance leaders understand their current AP processes and to help them evaluate the associated automation solutions. Ardent Partners defines “ePayables” as all of the solutions and services that automate all of (or parts) of the AP function.

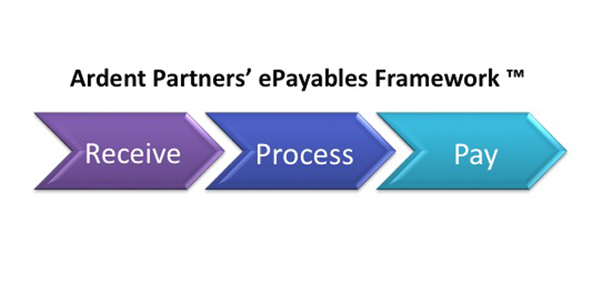

With our ePayables Framework we have divided and organized the AP process into three phases with multiple sub-steps within each phase:

While we have divided the AP function into three phases, we should clarify that these are not completely separate stages, but rather sections of the whole operation. When a change occurs in one phase there is often times a direct impact on the others. But segmenting the AP process into separate phases should hopefully help AP departments establish a clearer view on the current state of their operation. Having a better understanding into the activities within each phase will help to set standard operating procedures and also help determine best practices.

The first two phases, “Receive” and “Process”, include the different methods that AP organizations use to receive, validate, and process invoice information before it is scheduled for payment. Some of the most broadly adopted solutions tend to be from the front-end of the AP workflow. These include scan, capture, and workflow solutions, eInvoicing solutions, and self-service supplier portals. While both of these two phases are similar, it is the sub-steps that can vary depending on many different factors, such as the company industry, size, and/or geography. The level of automation already in place is also a differentiator between the two phases.

The “Pay” phase of the ePayables Framework includes both the schedule and execution of vendor payments. In this phase, there is more of an opportunity for AP to work with the treasury and finance departments in order to develop supplier payment strategies. The Ardent Partners research team has seen over the last several years that this phase has attracted the most attention from AP professionals. Supplier payments are many times the largest non-payroll source of cash outflows for an organization. So it makes sense that creating a robust supplier payment strategy to drive considerable financial value to the business at large is a high priority. Committing capital to ePayments solutions or business/payment networks is a great way to improve efficiencies and drive down costs.

Once current state processes are captured, it should be much easier for AP groups to measure their key performance and operational metrics. This can include invoice volumes by segment, metrics around invoice accuracy, and performance (accuracy and timing) within each phase. It takes time and effort to build a business case for investments in automation, but having an understanding of the framework of the AP function will put your department on the right path towards a transformation project.

RELATED ARTICLES

How Source-to-Settle Solutions Manage (and Leverage) Big Data – ePayments

How Source-to-Settle Solutions Manage (and Leverage) Big Data – eInvoicing

ePayables Technology Outlook for 2017 (Part 1)

ePayables Technology Outlook for 2017 (Part 2)

Tagged in: Ardent Partners Research, ePayables, Finance, Innovation, P2P, Process, Source-to-Settle, Strategy, Technology