Ardent Partners recently published our annual CPO Rising report (entitled CPO Rising 2014: Convergence) and of all the reports we publish this year, the focus of this report is exactly geared towards our regular readers (CPOs and those who aspire to the role). The report presents a comprehensive, industry-wide view into what is happening in the world of procurement and captures the experience, performance, perspective, and intentions of 273 Chief Procurement Officers and other procurement executives. As we do every year, we interview many Chief Procurement Officers (24 procurement leaders in total) to add context to this research effort. The report is available (with registration) from several sponsor sites including here, here, here, here, here, or here.

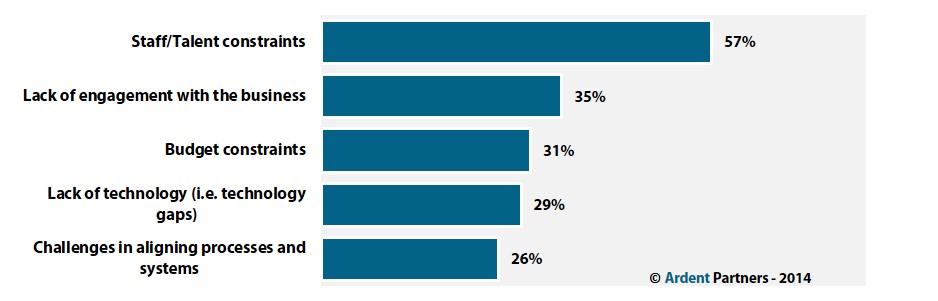

Chief Procurement Officers’ Top Challenges in 2014

Budget constraints are less pressing than they were a few years ago, but are still among the CPO’s top challenges in 2014, ranking 3rd overall as noted by 31% of all CPOs. Companies remain risk averse after the 2008-2009 economic downturn. As a result, many continue to sit on cash rather than make long-term, significant capital investments in people or technology. This has forced many procurement departments to “do better with same” and to increasingly leverage non-traditional talent, topics we covered last month on CPO Rising. Still, there are other internal forces at work – some that CPO’s can control, and some they can only influence.

The CPO’s Top Challenges in 2014

The competitive nature of how budgets are established in business dictates that there are some winners and losers – or at the very least, there are those that get a bigger share of the pie and those that get a smaller share. Budgets are finite resources to begin with; and finance and senior executives remain reluctant to part with cash to make significant investments, even when there is a clear return on investment (ROI) [Sidebar, these executives often hoard cash but the trend at publicly-traded companies is to returning it to shareholders in the way of dividends and share buybacks.]. As a result, those with perhaps higher-profiles within the enterprise – like product and sales teams – are more likely to receive a bigger share of the budgetary pie than procurement.

Even when CPOs can demonstrate significant ROI, procurement’s often towards the rear of the line for new investment dollars. This is particularly true for procurement departments around the globe as one Canadian-based VP of Purchasing told me while highlighting the challenge, “We can report and demonstrate fairly significant savings and yet in the budget, the headcount growth in our budget was limited. The appetite is not there to bring in more purchasing guys.” Inability to increase headcount is just one example of how budget constraints impact procurement. This also links back to the top CPO challenge regarding staffing size and talent – Limited budget means fewer resources, but it also means fewer tools and less training for that same staff The budget challenge also demonstrates a dilemma.

CPOs do not frequently “control” matters outside of their departments – particularly budgetary decisions – but they can influence key decision makers and build influence within other constituencies. Thus, it becomes even more important for Chief Procurement Officers to leverage their soft power by collaborating and engaging with strategic partners within the organization. Procurement’s relationship with finance readily comes to mind, as the latter is the engine that drives the budgeting process. Since the CPO has become one of the most influential business leaders across the enterprise, who better to press procurement’s case to the CFO than the CPO?

This is particularly true since many CPOs report to their Chief Financial Officers (CFOs). When CPOs have a powerful ally in finance to press or support their case, good things can happen. If that relationship is not yet established, or if the walls between AP and procurement still have not come down, securing greater budgetary share is a great reason to drive more collaboration and engagement between the two departments. With better alignment with finance, making the case for investment in headcount or more robust, automated technologies like eProcurement, eSourcing, and Spend Analysis tools becomes easier since the investment not only advances procurement’s mission, but also, aids AP (and treasury and finance)in its mission. So ultimately, a better linkage with AP can directly improve P2P operations and the interaction of procurement and finance; it can also, more indirectly, lead to a bigger procurement department budget.

RELATED ARTICLES

CPO Rising 2014: Convergence – Top Challenges in 2014 (I)

CPO Rising 2014: Convergence – Top Challenges in 2014 (II)

Chief Procurement Officers in 2014: Doing Better with Same

Accounts Payable and Procurement Collaboration: Two Hearts Beat as One

The Perfect Storm of Non-Traditional Talent

Tagged in: Ardent Partners Research, CFO, Chief Procurement Officer, CPO, Finance, Strategy