Fridays (in 2023) means that it’s time for another CPO Rising Listicle. Each list will include a variety of procurement tips, trends, insights, research, lists, strategies, and/or recommendations designed to help procurement teams improve operations. We’ll also include a summary graphic for you to share with your team.

We are two months into the second half of 2023 and US inflation rests at 3%, a percentage point higher than the Federal Reserve’s longer-run goal of 2%. While the inflation rate is descending in the US, it remains high on a global scale. In the United Kingdom, for example, inflation sits at 7.9%. Throughout the European Union, the average inflation rate is above 6% at 6.4%.

In the US, the Bureau of Economic Analysis reports that GDP grew 2.4% in the second quarter of 2023. The labor market remains tight with unemployment at 3.6%, a rate not witnessed in decades. However, according to the U.S. Bureau of Labor Statistics, the tight labor market provides the Federal Reserve with the flexibility to continue raising interest rates to fight inflation.

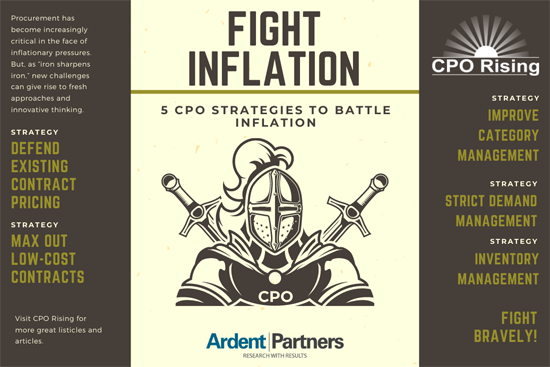

Five CPO Strategies to Battle Inflation

The role of procurement departments has become increasingly critical in recent years. This is especially true in the face of inflationary pressures. But, much as “iron sharpens iron,” new challenges can give rise to fresh approaches and innovative thinking.

- Improve Category Management: One of the most effective strategies for procurement departments in an inflationary period is to focus on category management. By understanding the specific needs of each category, procurement departments can negotiate better pricing and terms, reducing the impact of inflation. They can also work to build stronger relationships with suppliers, leading to improved supplier performance and a more reliable supply chain.

- Strict Demand Management: Demand management is balancing the supply of goods and services with customer demand. By understanding the demand for products and services, companies can adjust their production and distribution plans to minimize costs and avoid inflationary pressures.

- Inventory Management: Inventory management helps companies to reduce the costs associated with holding excess inventory. By adjusting batch sizes and order frequency, companies can optimize their inventory levels and minimize waste. This helps to reduce the need for price increases caused by inflationary forces.

- Defend Existing Contract Pricing: Defending existing contract pricing involves protecting existing contracts with suppliers, customers, and other stakeholders. This helps companies to maintain stable pricing and reduce the effects of inflation.

- Max Out Low-Price Contracts and Build Inventory: By taking advantage of low-price contracts and building inventory, companies can reduce the cost of goods and minimize the impact of inflation. This strategy helps companies secure the supplies they need at a lower cost and reduces the need for price increases.

RELATED RESEARCH

The Macro-Level Issues Impacting the CPO Right Now: Inflation

Procurement 2022: Big Trends & Predictions Part 2 – Inflation Ahead

Business As (Un)Usual – The CPO’s Top Strategies and Hurdles to Success