Editor’s Note: Over the next few weeks on CPO Rising, we’re publishing some “best of” 2020 articles as we reflect on the year and prepare for the new year ahead.

In a world where the speed of business increases moment-by- moment, and new competitors lurk around the next financial statement, it is imperative that enterprises of all sizes take a hard look at how they pay suppliers. The simple fact of the matter is that there is significant untapped value in the financial supply chain, particularly the supplier payment operation, which is available only to the enterprises savvy enough to take advantage of the tools and capabilities that can unearth it. Enterprises that do not closely examine their payment processes to ferret out inefficiencies and push for change, run the risk of not only wasting their staffs’ time and money, but also falling behind the competition.

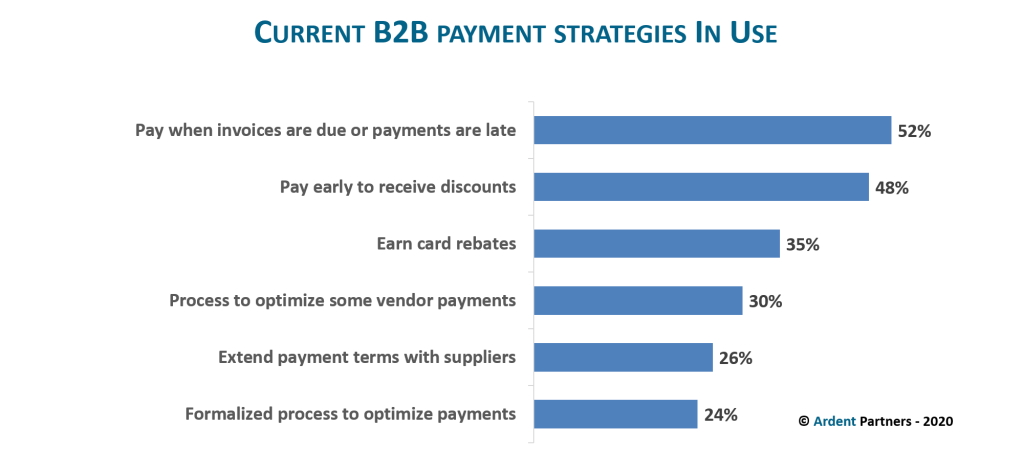

Many AP and finance leaders have heard the call and have been focused on developing a greater level of sophistication in how they pay vendors. When analyzing different B2B payment strategies and the percentage of enterprises that employ them (as shown in the figure below), the numbers do not indicate a high level of sophistication in the market today; that said, more enterprises are starting to focus on it.

Focus on B2B payments is required for the AP function to optimize cash flow and better support and provide value to the greater enterprise. Just as invoice processing can drive value when efficiencies and intelligence is captured, the B2B payments area can likewise produce benefits that range from significant cost reductions (when ePayments are in the mix), long-term financial value, superior cash management (through approaches such as supply chain finance, rebates on card spend, early payment discount capture, dynamic discounting, etc.), reduced risk of fraud, and, enhanced spend visibility.

One area where Best-in-Class AP departments show a big advantage is with ePayments. Leading AP teams are 60% more likely to leverage ePayments than everyone else. By doing so, they have eliminated the deficiencies associated with paper-based checks, while also enabling greater payment agility, speeding up payment times, lowering costs, improving compliance, mitigating fraud, and providing superior visibility into organizational cash flow. More and more organizations are slowly starting to realize what the Best-in-Class have known for a long time, electronic B2B payments should be viewed as a strategic resource that will add value to any enterprise.

Editors Note: For more information on B2B payments, please download Ardent Partners’ recently released 2020 B2B Payments Technology Landscape report.