Due to the rise of business process automation tools, cloud-based applications, mobile solutions, and connected devices permeating the modern business environment, more data is being created each year than ever before. The result is a world that has become increasingly data-driven, and businesses around the globe have an extraordinary opportunity to capitalize on it. The same holds true for Accounts Payable (“AP”) departments who are increasingly able to convert data into intelligence and value. The main uses for data and intelligence within AP show that many departments are on the verge of a data- led transformation.

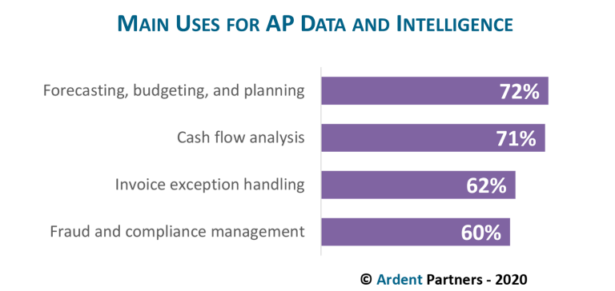

AP’s thirst for data is no mirage. As shown in the chart above from Ardent Partner’s ‘State of ePayables 2020’ (click to download) market research report, AP leaders understand the information that their efforts, systems, and processes collect can be a valuable foundation for critical, strategic financial activity, including:

- Forecasting, budgeting, and planning. While standard forecasting and planning relies on current data, it is a much better approach than no planning at all. Invoice, payment, spend, and supplier data are all rampant within the world of AP, and this information, when harnessed properly, can be incredibly valuable within the department and across the operation. With the advent of more agile analytics (and the advanced reporting capabilities inherent in many of today’s AP automation and/or P2P platforms), planning, forecasting and budgeting can arm CFOs and controllers with actionable intelligence.

- Cash flow analysis. The old adage, “cash is king,” could not be more relevant today. During times of economic peril, businesses that have access to cash can weather major storms, survive challenging times, and leverage liquidity to endure, and sometimes even thrive, in a crisis. Having the data-led insights to better understand, and therefore, manage, cash-on-hand, outstanding liabilities, as well as anticipate potential cash shortages or surpluses, can go a long way towards optimizing working capital, ensuring continuity, and aiding the overall viability of the enterprise.

- Invoice exception-handling. The very bane of the AP function is a seemingly consistent issue for this group. Invoice exceptions are speed bumps in the AP processes that can drastically extend approval time and the overall workflow. Accessing data that can help fix mistakes and support root cause analyses can be an incredible boon in resolving exception-related issues once and permanently before they become repeat offenders. Intelligence leveraged to handle invoice exception-handling also greatly frees up staff time and allows AP professionals to conduct more strategic, value-added tasks.

The AP profession continues to mature and more firmly establish its place within the larger enterprise. In Ardent’s ‘State of ePayables 2020’ market research report 86% of AP leaders stated that data and intelligence is either “critical” (41%) or “important” (45%) to their overall function. The knowledge captured by an AP function can help it improve its own operations; it can also be used to support financial (and procurement) decision-making, and help transform supplier relationships. These importance of data in AP has slowly but steadily risen over the past decade and is a clear sign that AP is thinking more and more about how it can become strategic and value-adding to the organization.

Tagged in: Ardent Partners Research, Bob Cohen, ePayables, ePayables 2020, Innovation, Process, State of ePayables, Strategy, Technology