[Editor’s Note: Ardent Partners recently published our annual AP-themed report, The State of ePayables 2018: The Future of AP is Now. Today’s article is part of an on-going series focused on the report’s key findings. If you would like to get the full report, it is available for download here (registration required).]

The discussion of where Accounts Payable (“AP”) can go in the months and years ahead is deep and complex. The AP function has many avenues in which to not only enhance its own operations but also become a true partner in the digitized enterprise of the future. Both strategy-led and innovation-heavy approaches pave the way for AP’s future over the near and longer term. But no AP department, or enterprise for that matter, operates in a perfect vacuum. Although market pressures (borne by the weight of needing to “keep up” with digital innovations) may hijack the minds of key executives and force them to condense transformation timelines, the truth is that every organization is different. What works for one enterprise in regards to digital enhancement may not be aligned with another.

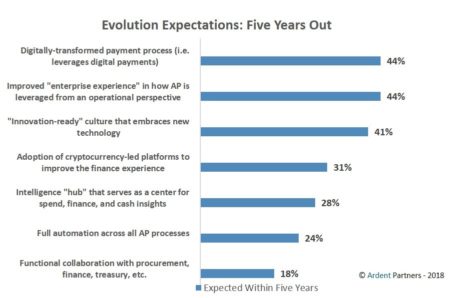

Last week, I discussed the two year trajectory of the AP function. But it is also helpful to understand how AP will look a little further out from that in order to get a broader understanding of where the function is heading, and how best to prepare. In Ardent’s ‘The State of ePayables 2018: The Future of AP is Now’ research report, we discuss several key aspects that are expected to play critical roles in the ultimate evolution of the AP function over the next five years, as shown in the Figure below.

AP 2023: The Five Year Outlook

As shown in the figure above, the AP function of 2023 is expected to be founded on two major principles: the finance “experience” and the adoption of futuristic financial innovations. These two themes include:

Digitally-transformed payment process (44%): B2B payments can play an invaluable role in altering payment management within the enterprise. Almost of those surveyed plan to adopt ePayment technologies within the next five years. There is a huge opportunity in this area right now for organizations that want to lower costs, improve cash flow, and eliminate manual, paper-based inefficiencies. While paper checks may have worked well enough in the past, more and more organizations are realizing that automating the payments process is vital for AP to reach its full potential.

Improved “enterprise experience” in how AP is leveraged from an operational perspective (44%): These days, many progressive business strategies follow the path tread in the world of the consumer: on-demand content, real-time results, and immediate insights. It is interesting to note that forty-four percent (44%) of businesses expect an improved “enterprise experience” in regards to how AP works from an operational perspective. This innovative approach involves AP working as a seamless “service” for other collaborators and stakeholders, providing on-demand intelligence as needed, and becoming a true part of the digital future of the enterprise. If the business of 2023 will rely on an “experience-based” strategy to generate real-time decision-making, AP will, in all likelihood, be a key part of it.

Adoption of cryptocurrency-led platforms to improve the finance experience (31%): Cryptocurrency is currently one of the hottest topics in the world of Finance and “FinTech” (financial technology). The underlying platform that supports cryptocurrencies like Bitcoin, Blockchain, has been revolutionizing specific aspects of the finance function in its small number of adopters thus far. Thirty-one percent (31%) of AP leaders expect Blockchain to be included in the wide swath of financial automation in the future, mainly due to its “unhackable” nature (Blockchain automatically creates a permanent, unalterable database of transactions) and incredibly fast settlement times. To improve the “experience-led” approach of finance in the future, Blockchain will assist in generating a more real-time functionality to not only handle payments, but also track, monitor, and measure the myriad aspects and figures that are related to the accounts payable function.

Conclusion

Forward-thinking AP teams are constantly looking toward the “next step” required to push the AP department to a higher level of performance. This is an important attitude to have, especially because the business world is only becoming more competitive. Reaching key goals over the next five years, such as the addition of futuristic technologies to automate key aspects of the P2P process, and building an improved enterprise experience, can help AP teams to stay competitive and showcase their true strategic value to the enterprise. The future is bright for AP, now it is up to its leaders to take advantage.

Join Ardent Partners September 5th @ 2pm ET for our latest webinar entitled “The State of P2P in 2018: It’s Money That Matters” (click here to register).

RELATED ARTICLES

Download the State of ePayables 2018 Report!

The State of ePayables 2018: The Expected Trajectory of AP – Part I

The State of ePayables 2018: What Makes the Best AP Departments Better?