[A note from the editor: Last week, Andrew posed the question – How Do You Define Spend Under Management? – and invited others to offer up their answers because we think that it is time the procurement community to find and adopt a broadly accepted definition of the metric. Today, our first “answer,” in what we hope will be an ongoing discussion on these pages and across the industry. We invite all others to chime in and share your definition of spend under management and the thought process behind it by emailing us, posting a comment in our LinkedIn group, or proposing to write an article that could be published on CPO Rising. We’d love to hear from you.]

A Proposed New Definition for “Spend under Management”

By Amit Duvedi

In the 2014 CPO Rising Report from Ardent Partners, the analyst firm announces a bold, year-long initiative to work toward an industry-standard definition of “spend under management.” In the final segment of our interview series with Andrew Bartolini, lead analyst at Ardent, we asked him, why now?

Bartolini believes refining that definition is crucial to helping organizations more accurately benchmark their performance in order to perform as well as they can, and that we’ve gotten to the point where this can be done. We agree, and want to be part of that conversation. Today, Amit Duvedi, Vice President Business Strategy at Coupa shares his proposal for a new definition.

“How much spend do you have under management?”

My role at Coupa is to help companies establish a business case for technology to better optimize spend. This is usually one of the first questions I ask, so naturally I believe there is a lot of value to be had by arriving at a clearer definition. How else can you put the cost of a system into the context of the opportunity for savings?

Analyst firms like Ardent Partners and Aberdeen have been tracking and benchmarking spend under management for a long time. We’ve seen these numbers consistently improve: According to current benchmarks, an average-performing company might have 55-60% of spend under management. A best-in-class company may be at 85%; Companies that are not doing as well may be at 35% or less.

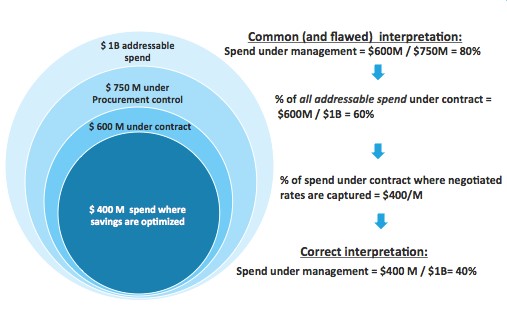

When we talk about percentage of spend under management, it implies a ratio of spend that is actively being managed versus all addressable spending. The problem with our current definition is that there’s too much room for interpretation of what constitutes addressable spending, and about what “under management” truly means. Before discussing what I think the new definition should be, let me start with a couple of common, but flawed interpretations of these two aspects of the current definition.

Flawed interpretation # 1: Overall spend = Spend under Procurement control

Many companies I talk to interpret “overall spend” as spend the Procurement department actively controls or influences. In some companies this might include most spend categories, but in most organizations Procurement is only influencing a subset of all addressable spend. For example, they might not have any influence or control over Marketing, Legal, or IT spend. In such cases, these companies always say their percentage of spend under management is very high – typically more than 80%. But that’s a flawed and inflated number because they are essentially leaving spend that can and should be going through Procurement out of their calculation.

Flawed interpretation # 2: Spend under management = Spend under contract

Some companies consider spend under management to be one and the same as spend under contract. That’s problematic. Just because a contract exists, doesn’t mean spend is being managed. In a perfect world, “spend under contract” and “spend for which existing contract rates are leveraged while buying” would be one and the same, or at least very close. The reality is, there’s often a gap large enough to drive a delivery truck through.

To really have spend under management, you’ve got to do sourcing to establish favorable rates with your preferred suppliers. Then you’ve got to get spend under contract, and get the contracts into a Procurement system. Then you need to have the visibility and controls in the system to make sure that people are guided to the contracted suppliers and they actually use negotiated contract rates when buying.

This is at the heart of managing spend. If your sourcing department negotiates these contracts but users can’t find them in the system, or the policies aren’t clear, or they aren’t guided to the negotiated rate, they’ll buy off contract and outside the system and those negotiated savings are lost. It’s kind of like clipping coupons and then forgetting to bring them to the grocery store with you. This is why we cannot use “spend under contract” as our definition for spend under management. There is too much potential for unrealized savings.

That’s why I propose that spend under management be defined as the “spend for which savings have been optimized,” expressed as a percentage of all addressable spend.

All addressable spend, in this definition, includes all spend except payroll, taxes, depreciation, and amortization, rent, utilities, and maybe a few other categories where further savings are not possible. Everything else is fair game.

So, what does “spend for which savings have been optimized” really mean? It’s the spend that Procurement is influencing through a Procurement system and buyers / employees are using the negotiated contractual rates at the time of Purchasing.

Using my definition, what this company really has is 40% ($400 million out of $1 billion) spend under management. This definition implies a lot of opportunity for incremental savings.

Let’s say for the sake of argument that I’m talking to a company with a billion dollars in addressable spend. Procurement has oversight for $750 million, and of that and they have $600 million under contract. Buyers are using negotiated contractual rates for $400 million out of the $600 million under contract.

Under flawed interpretation #1, such a company might typically claim 80% of spend under management (i.e., $600 million is 80% of $750 million). This definition implies very little opportunity for further spend savings. But what about that other $250 million in addressable spend? There’s opportunity to bring that under management.

Under flawed interpretation #2, there’s also $200 million of maverick spend, where buyers are not using the low rates that have already been negotiated at the time of purchasing.

Using my definition, what this company really has is 40% ($400 million out of $1 billion) spend under management. This definition implies a lot of opportunity for incremental savings.

For me, this is the only definition that doesn’t leave money on the table. “Influenced” spend is too fluffy. “Spend through a system” is too tactical. “Spend under contract” is too theoretical unless negotiated savings are flowing through to your bottom line.

It’s stricter definition, to be sure, and it raises the collective bar. The benchmarks would have to shift; organizations that think they’re at 60 or 70 or 80 percent of spend under management may have to acknowledge that they’re not doing as well as they think they are. That’s the reality of what I see anyhow. It doesn’t really serve anyone to paint such a rosy picture.

We probably need to have more of a conversation to nail down exactly what constitutes addressable spend. But to my thinking, the last part of this definition is spot on, because if you’re not optimizing, you’re not really managing.

RELATED ARTICLES

How Do You Define Spend Under Management?

Accounts Payable and Procurement Collaboration: Two Hearts Beat as One

AP: Collaborator, not Administrator

Pingback: Increase spend under management, increase savings - Tamr Inc.