Ardent Partners recently published our annual ePayables report, “ePayables 2014: The Quest,” and like all of our payables reports this year the research is geared toward financial managers, executives, and those who aspire to these roles. The report presents a comprehensive overview of the state of accounts payable, as well as focusing on ePayables technology and systems and providing a way for accounts payable teams to benchmark themselves against the Best-in-Class and improve their overall performance.

We spoke with over 190 accounts payable, finance, and other professionals across 25 different industries to give our readers a complete picture of the state of the market. The report is available for free (registration required) at three report sponsor sites: Ariba, Taulia, and Tradeshift [Note: The report is also available directly from Basware].

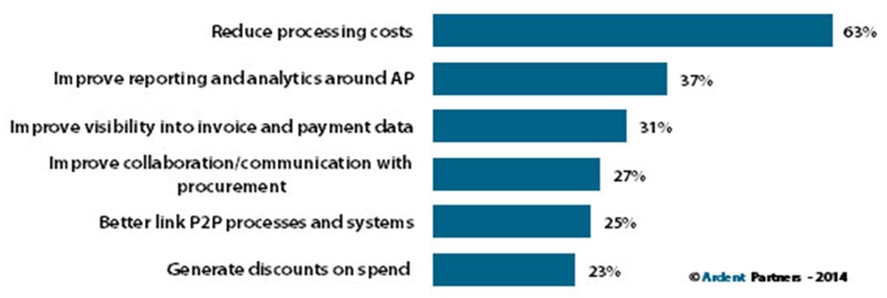

The AP Team’s Top Priorities for 2014

Accounts payables professionals at organizations large and small are routinely forced to do more with less. The advent of ePayables makes this feasible; outdated manual processes can be replaced with fully or mostly automated techniques such as straight-through processing and dynamic discounting, which leaves the harried AP pro to take care of exceptions instead of entering data and manually processing invoices.

Automation is all well and good – and a laudable goal – but before you consider moving toward that pathway, it’s worth considering where your priorities lie. For the majority of AP departments, our recent ePayables research uncovers that the top priority, by significant margin, is the reduction of processing costs (see figure below).

We’re not surprised that lowering processing costs remains the top priority among AP and finance leaders, as some form of process-related issue recurs year after year in our annual survey. Our current ePayables 2014 research even uncovered that the average cost to process an invoice is $14.21, which represents a fully-loaded charge including staff time, managerial overhead, facilities, and IT support. This is in direct contrast to the Best-in-Class in the ePayables 2014 dataset, which as a class have processing costs that are 60% to 80% lower than manual- and paper-based processing.

The other priorities are also aligned with our earlier research. Analytics and reporting, in addition to data visibility (priorities two and three, respectively), offer the promise to improve AP operations significantly. After all, as Peter Drucker once said, “You can’t manage it if you can’t measure it.” Reporting capabilities enable AP leaders to track the “metrics that matter” to measure performance and results across a host of areas. It also allows AP teams to quickly identify issues and course-correct as needed. Access to invoice and payment data is valuable to AP to help mitigate exceptions via “root-cause” analysis as well as improve operations more broadly, but the data is also extremely valuable to AP’s functional partners like procurement (for improved spend analysis, compliance audits, and supplier performance management) and treasury (for more informed payment and cash management planning)

That the AP team’s top priorities for 2014 focus around improving visibility and reducing cost shouldn’t come as a shock. AP is constantly tasked with processing more invoices, at a faster pace, than they ever had to before. Improving systems, reducing costs, and heightening collaboration with procurement teams can only help provide the wherewithal to reach the overarching goal of driving efficiencies, improving effectiveness, and turning AP into a more valuable business function within the organization.

RELATED ARTICLES

CPO Rising’s 2014 Hot Tech Prospects – Taulia

It’s a Brand New Day: AP Skill Sets Must Evolve with Automation

Three Must Know Stats about Electronic Payments

Profile of a Best-in-Class AP Operation: Disney