Who said eInvoicing costs less?

Actually, the market did. As you have already seen in other articles (such as this one or this one), Ardent Partners recently completed a fairly robust study on the accounts payable function and the technologies that are improving the performance and efficiency of invoice and payment processing. Cost is and has been the biggest driver for modernizing the AP process; despite many ongoing initiatives, the average market costs remain high. For example, the enterprises that participated in Ardent’s research effort had an average cost to process an invoice of just over $13. Within that group, there are enterprises performing at a much higher level and at a fraction of the cost ($2-3 per invoice).

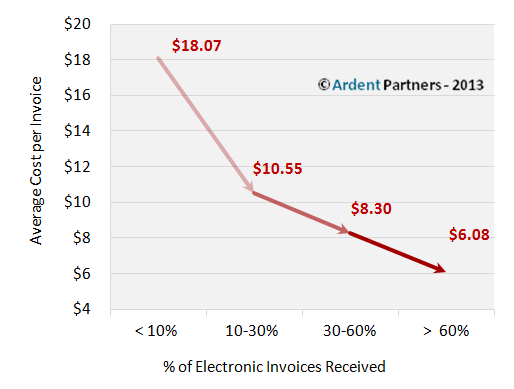

In an effort to better understand this, Ardent analysts drilled down into the data to determine the impact that technology has on invoice processing costs. Ardent analyzed how the average cost per invoice changes as the percentage of electronic invoices received increases.

The results were quite revealing (see chart below). When a company receives fewer than 10% of its invoices electronically (this does not include invoices that go through imaging and OCR), there is no significant impact on the average cost. However, when the percentage of eInvoices received increases to between 10-30% there is a big drop in the average cost to process an invoice. This cost continues to drop as the percentage of eInvoices received goes up.

Why does this happen? Well, receiving more invoices electronically reduces the need for data entry or manual validation and matching, which is all done automatically with eInvoicing. There are bound to be fewer errors and discrepancies due to the business rules that can be put in place. Digital formats also enable straight-through processing, which makes the approval process more efficient and greatly increases the number of invoices processed per FTE, thereby reducing operational costs.

There are many eInvoicing solutions in the market today. Below are two solution providers worth considering in your efforts to reduce costs and transform AP.

ADP – Although best known as a provider of HR and payroll related solutions/services, the company also offers eInvoicing and related procure-to-pay solutions. This robust solution includes a supplier network, vendor portal and sophisticated dynamic discounting capabilities. This mature solutions also offers sophisticated capabilities such as contract matching, price compliance capabilities the ability to make payments via check or ACH.

Hubwoo – Operator of a sizable global B2B network and procure-to-pay solutions including sourcing, eProcurement, contract management, eInvoicing and other supplier specific capabilities via the network. While Hubwoo’s roots lie in sourcing/procurement their eInvoicing capabilities are surprisingly mature. For e.g., the buying organization can enforce certain conditional rules and tolerances to ensure that eInvoices are pre-matched while still in the supplier portal and before they are submitted by the supplier

RELATED ARTICLES

ePayables Solutions (Part 1): Scan, Capture, & Workflow

ePayables Solutions (Part 2): eInvoicing & Networks

ePayables Solutions (Part 3): Payments

Payables Place Asks “Would You Bet On Paper or Against It?”