If procurement warrants a C-level role within the enterprise (and by the title of this site you know that we think it does), the Chief Procurement Officer should begin to develop a direct relationship with the CEO. That doesn’t have to mean Thursday squash and mutual family vacations; a formal meeting at some regular interval is a good place to start. At the Zycus Experience event this Thursday in LA, I will be discussing some of the BIG Trends in Spend/Supply Management as we look out over the next decade. One of those trends is executive engagement which I expect will grow exponentially in the next decade. This quick, but absolutely fantastic, case study below of true CEO engagement is one I have been presenting recently and shows that this “trend” has already begun. Consider sharing this article with your executives – CEO, CFO, COO – to show that leading CEO’s are fully engaged with procurement today.

Case Study: CEO Engagement

QUOTE 1: “Companies that deliver improved execution during the tough times will be the ones best positioned to capitalize on the economic turnaround which will most certainly occur. To be successful in 2009 we need to deliver on improving execution across the supply chain.” ~ Bob Eckert, Chairman and CEO, Mattel Inc. Corporate Earnings Call April, 2009

QUOTE 2: “In 2009, we improved execution across the supply chain and throughout the company by realigning our infrastructure, controlling costs and expenses, tightly managing working capital especially inventories and reducing capital spending by doing only business critical projects and doing them exceptionally well.” ~ Bob Eckert, Chairman and CEO, Mattel Inc. Corporate Earnings Call February, 2010

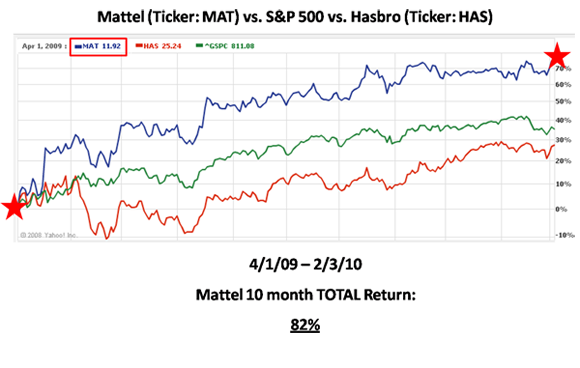

In his second quote, Eckert described what happened inside the company over a multi-month period. The chart below shows what happened to Mattel’s stock during that same period.

Certainly the performance of Mattel’s stock (which is compared to the S&P 500 and competitor Hasbro in the chart above) is not solely attributable to procurement and supply chain performance. There are many other factors. But, Eckert went on to say that Mattel’s procurement and supply chain performance led to improved profitability, a stronger balance sheet and improved cash flow which we used to lower debt, increase cash balances and continue to reward shareholders through our strong annual dividend.

Certainly the performance of Mattel’s stock (which is compared to the S&P 500 and competitor Hasbro in the chart above) is not solely attributable to procurement and supply chain performance. There are many other factors. But, Eckert went on to say that Mattel’s procurement and supply chain performance led to improved profitability, a stronger balance sheet and improved cash flow which we used to lower debt, increase cash balances and continue to reward shareholders through our strong annual dividend.

Yesterday, I actually traded emails with Carol Danoff, Vice President, Global Procurement at Mattel to discuss our participation/attendance at a few events over the next few weeks. I am excited to meet her, see her presentation on the successes of her organization (at the Zycus event in LA on Thursday) and discuss executive engagement at Mattel. I’m sure Bob Eckert knows her well.

Reminder: For those of you that lack the full support and engagement of your executive team, consider sending this article to them and show that CEOs who are focusing their efforts and resources on procurement are seeing big returns.

Great point, Andrew! A top down push can only help the cause. I attended one of the Zycus Experiences recently and had the opportunity to hear you speak. Great job and I would encourage others to go hear Andrew in LA!

Andrew, our company has good interaction at the C-level and when a key opportunity is identified and endorsed across the C-level, results can happen quickly. Some times the challenge is in quantifying the size of the opportunity, so it can be given the green light. I’ve learned that ROI is one way of stating the size of the opportunity, but another approach that will get traction quickly is in terms of earnings. If you know how many dollars have to be ‘saved’ to deliver a penny to the quarterly earnings, don’t be afraid to express the opportunity in this manner. Take the time to prepare your data well, present it to your CPO or CSCO and let them ‘beat it up’. If they are sold on the sourcing or supply chain savings plan, it should be an easy conversation for them with the CEO and once the CEO is on board, moving forward quickly is easy. When the CEO is sold on a concept presented in terms of ‘earnings per share’, they will pave a smoother path for you in terms or resources, cooperation and visibilty from other key departments. The key is the open line of communication between the CPO/CSCO and the CEO, then speaking (or internal selling) in terms the CEO can identify quickly with – earnings per share is a language they understand and it might get you further faster than a traditional ROI presentation built off the same numbers, especially during tough economic times.

Kirk –

Great comment! For the past year, I have been using a slide that shows how much revenue it takes in certain industries to earn $10 million (depending on industry, the answer can range from $100-$300 million, higher in some verticals). Then I ask the audience to consider the level of effort needed to sell $100 million – you see where this is going….. In fact, Carol Danoff (who I reference in this article) told me last week that when she was at Colgate-Palmolive, they used to equate their savings to the number of toothpaste tubes that would need to be sold to generate the same impact. 4 out of 5 CPOs would be wise to do the same type of calc., make that 5 out of 5.