Ardent Partners recently published our annual ePayables report, “ePayables 2014: The Quest,” and like all of our payables reports this year the research is geared toward financial managers, executives, and those who aspire to these roles. The report presents a comprehensive overview of the state of accounts payable, as well as focusing on ePayables technology and systems and providing a way for accounts payable teams to benchmark themselves against the Best-in-Class and improve their overall performance.

We spoke with over 190 accounts payable, finance, and other professionals across 25 different industries to give our readers a complete picture of the state of the market. The report is available for free (registration required) at three sponsor sites: Ariba, Taulia, and Tradeshift. [Note: The report is also available directly from Basware].

What’s Next for AP Teams in 2014?

Accounts payable has gone through significant changes in the past 14 years. At the beginning of the last decade, all invoices were paper or PDF over email, digital business networks were nary a glimmer in their creators’ eyes, and inefficiency reigned supreme. Today the AP automation ecosystem has changed significantly: straight-through processing is possible, top companies pay a mere $2.42 to process an invoice (enough for your morning Starbucks), and it is now possible for a single AP staffer to process nearly 5,000 invoices by themselves.

Accounts payable has gone through significant changes in the past 14 years. At the beginning of the last decade, all invoices were paper or PDF over email, digital business networks were nary a glimmer in their creators’ eyes, and inefficiency reigned supreme. Today the AP automation ecosystem has changed significantly: straight-through processing is possible, top companies pay a mere $2.42 to process an invoice (enough for your morning Starbucks), and it is now possible for a single AP staffer to process nearly 5,000 invoices by themselves.

Moving on up to Digital

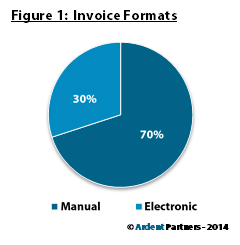

All of these changes are heartening, but the issue remains that 70% of invoices are still paper-based (Figure 1). Whether that’s PDF over email, an attachment, mail, or fax, this means that almost three-quarters of all invoices received by the average enterprise are still pieces of paper that must be scanned or captured into an ERP or AP system for processing.

So it’s good news that this coming year, more AP departments plan to focus on moving to eInvoicing, where the invoice is a digital file from start to finish without any scan-and-capture in between. A full 62% of respondents in our recent survey plan to either start an eInvoicing project within the next two to three years, or have set targets to increase their number of digital invoices. This can lead to increased efficiency and cost-savings by cutting down on exceptions.

New Organizational Capabilities

AP automation, which we call ePayables, can provide tremendous benefits to a company’s bottom line. Whether you’re talking about automating approval routes or optimizing working capital, you can end up at a significant cost-savings through automating some or all of your invoice processing. The goal of straight-through processing, where minimal human interaction is needed, can and does offer up cost- and time-savings to the tune of 60% to 80% over mostly paper- or manual-based processes.

Over the next two to three years, in fact, we can expect many of these automation and measurement capabilities to appear in more and more AP/finance teams. Many AP teams already have two- or three-way matching capabilities, where a PO can be matched to an invoice and/or to system information, and more plan to add in that functionality over the next few years. Should those plans to implement bear out, we could see nearly 100% adoption of two- or three-way matching functionality in a few years.

Perhaps most interesting is the growth potential for areas like working capital management and early payment discounts. Only about a quarter of respondents to our 2014 ePayables survey already have tools in place to optimize working capital or to efficiently capture those early payment discounts; the numbers of AP teams looking into such tools, however, approaches fully half of our survey pool. This is a fantastic opportunity for financing solution providers like Taulia and trade-network providers like Basware and Tradeshift.

By far, the most plans center around complete P2P linkages and straight-through processing. Straight-through processing, also known as touchless processing, is a drum that we’ve beaten for quite some time now. There’s a good reason for this – more invoices sent through a touchless processing workflow means that less staff time is spent verifying invoices, which can result in significant cost savings over the long term. That 51% of organizations plan to implement such an initiative is a clear mandate of the technique’s power.

That complete P2P linkage I mentioned, is of the most interest to AP teams moving forward–by almost five percentage points compared to the others. AP and finance teams appear to have finally recognized the value in a complete procure-to-pay linkage and the efficiencies they can derive from such an arrangement. It will be intriguing to see what happens.

The Next Few Years …

The long and short of it is that AP/finance departments are in an almost constant state of flux. As more automation happens globally, and financial supply chains become tighter, the importance of ePayables can hardly be undersold as an efficiency gainer. The more efficient you are, the cheaper your financial operations become. The cheaper your financial operations become, the more likely you are to increase net revenue because you won’t be spending so much time making sure all the invoices get paid on time and in full anymore. And this is a goal everyone can agree on.

RELATED ARTICLES

ePayables 2014: Top 3 Roadblocks to Cost-Savings in Accounts Payable

ePayables 2014: The Quest – Top Priorities

CPO Rising’s 2014 Hot Tech Prospects – Taulia

CPO Rising’s 2014 Hot Tech Prospect – Tradeshift

It’s a Brand New Day: AP Skill Sets Must Evolve with Automation

Tagged in: Adoption, Ardent Partners Research, CFO, ePayables, Finance, P2P, Process, Solution Providers