According to authors P. Montana and B. Charnov (in the 2008 edition of their book, Management) by way of Wikipedia, Corporate culture is defined as the “total sum of the values, customs, traditions, and meanings that make a company unique. Corporate culture is often called ‘the character of an organization,’ since it embodies the vision of the company’s founders. The values of a corporate culture influence the ethical standards within a corporation, as well as managerial behavior.”

Are there certain characteristics of an organization that are better suited than others for driving the adoption of technology by end users within the enterprise?

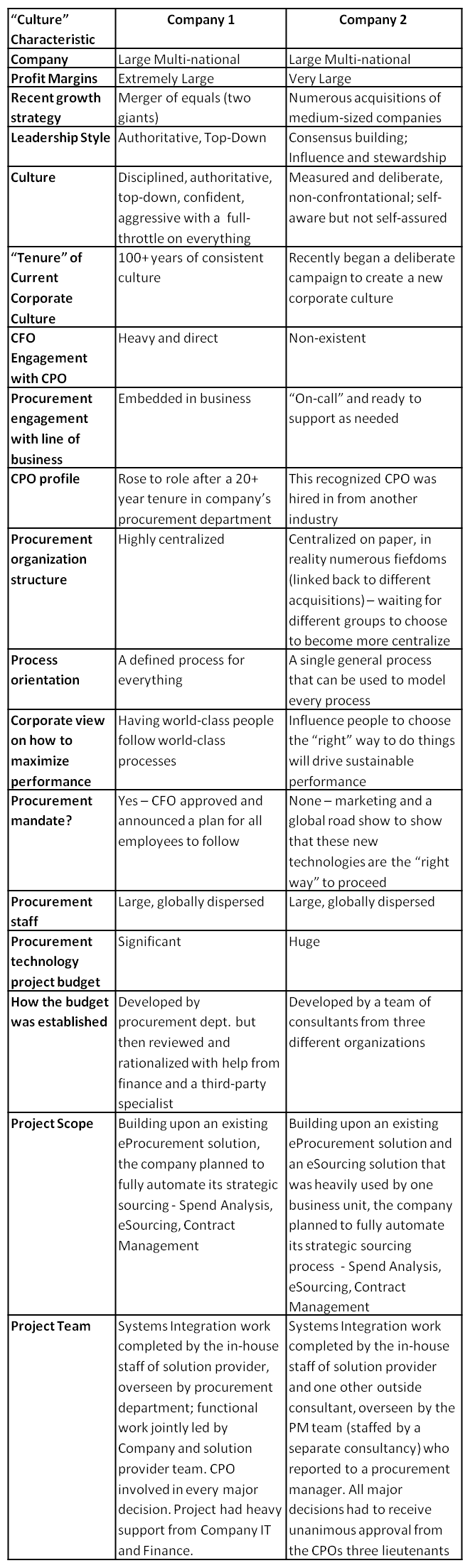

To help understand the issue, we have spent the previous two articles in our Adoption series describing the cultures of two companies operating in the same industry (managing the same type of spend) and analyze the results from the initial years of their deployments of supply management technology suites. The chart below is designed to summarize the different corporate cultures at the rival companies. It includes some of the highlights from this article about Company 1 and this one about Company 2. I have also included some new information about each company too (apologies for the length). The results from each Company’s project are below the chart.

Company #2 Project Results:

Eighteen months after the initial project kickoff, the eSourcing tool (which had been active) was relaunched on a new version and a small but steady flow projects began to run each month with the heavy support of a full-service eSourcing team that operated as a hybrid help-desk and event management team; the majority of events were run by the one business unit that had been using the tool before the project. After three years, the adoption of eSourcing by other groups was minimal.

Four months after the re-launch of the eSourcing tool, four specific “project management” templates were launched – three were designed for the management of different sourcing projects (simple, intermediate and complex), while the fourth was designed to manage the post-award implementation of suppliers. No parameters were set on which project management template should be used for different situations; the templates were used less than 50% of the time. The internal “supplier implementation” project lead transferred near the end of the project and the template was never used.

24 months after project kickoff, Spend Analysis went live; last minute changes in requirements and a project team team overhaul kept the system from becoming fully-operational for another 12 months or more than 3 years after project launch.

The contract management part of the project was shelved six months into the project; three years later it was added back in and by year four of the project, a contract repository was launched. After 12 months in operation, the repository contained an estimated 80% of all active ‘large contracts.’

Five years after the project began, 20% of the consultants on the original project team were still engaged full-time with the project.

Five years after the project began, Company 2’s initiative was on a run rate that was 70% below its initial “steady state” targets. These targets were not aggressive when compared to the numbers used by Company #1 to model its expected ROI.

Company #1 Project Results:

Eleven months after the initial project kickoff, a fully-operational suite of integrated solutions including Spend Analysis, eSourcing, Contract Repository, and Contract Authoring was in place. The system also included a ‘project management solution with more than 40 different templates for different types of sourcing/procurement/supply management projects. The system handled hundreds of sourcing projects each month, offered enterprise-level visibility into 90% of total spend, contained 95% of all legacy contracts and was the mandated system for any procurement contract above a certain dollar threshold.

User adoption was widespread and prevalent. The project team for Company 1 had 75% fewer outside consultants and its final implementation budget was about 10% of Company 2’s.

Company 1 saw a full project payback in under two years.

Summary

Two companies that were equally suited to a very similar task – each with a very different culture and diametrically opposite results. We’ll follow-up next week with some final thoughts on the topic.

Tagged in: Adoption, Case Study, Chief Procurement Officer, CPO, Strategy, Technology