After a sly rambling preamble about the acidic rain of costly pennies from heaven, our discussion last time, A Penny Saved, turned to the extraordinary impact that ordinary procurement results can have on a company’s profitability. I refer to this phenomenon as procurement leverage.

Our analysis today focuses on net profit margin and how the large contribution from procurement should play amongst corporate executives. Procurement contribution can be the impact of savings or the benefits of demand management or the value of efficiencies or the positive effects of extending DPO or the contribution of cost avoidance (That’s right, I said it – cost avoidance, too) or it can be a combination of two or more or all of these things and/or any of the other ways that procurement can create financial value. For now, we will put aside the discussion of savings calculations, internal negotiations and processes. We will put aside the differences between realized and booked savings and the gap between the credit procurement gets for its efforts and the credit it deserves. Once I get a little further ahead of schedule in writing these articles, I promise to revisit the entire savings topic in a series of posts – it is a topic as interesting as it is confounding. Back to margins and leverage.

Net Profit Margin Definition

According to Investopedia

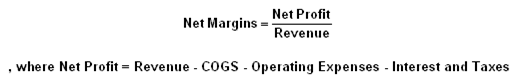

The ratio of net profits to revenues for a company or business segment – typically expressed as a percentage – shows how much of each dollar earned by the company is translated into profits. Net margins can generally be calculated as:

Investopedia continues by adding:

“Net margins will vary from company to company, and certain ranges can be expected from industry to industry, as similar business constraints exist in each distinct industry. A company like Wal-Mart has made fortunes for its shareholders while operating on net margins less than 5% annually, while at the other end of the spectrum some technology companies can run on net margins of 15-20% or greater.

Most publicly traded companies will report their net margins both quarterly (during earnings releases) and in their annual reports. Companies that are able to expand their net margins over time will generally be rewarded with share price growth, as it leads directly to higher levels of profitability.”

Which to quickly summarize tells us three things:

- Most companies track and report net profit margins

- This metric differs by industry and company

- All things equal, companies with higher net profit margins are more valuable to investors

The MSN Money Advisor advises that

Net margins can provide a sizeable competitive edge, so always compare them to the average for the industry. A company with higher net margins can spend more on product improvements or state-of-the-art factories. In an industry-wide downturn, a company with a low net margin even in good times might be forced to borrow just to meet costs and is almost certain to lose ground to more profitable competitors. Comparing net margins across the companies in an industry is also a good way to get a quick handle on the quality of management. Good managers should be able to wring more profit out of each dollar of sales (although an investor needs to make sure that management isn’t getting higher temporary profits by neglecting long-term investment in the business).

Which to quickly summarize tells us three more things

- Net profit margins can indicate a competitive advantage within an industry

- Investors may look at net profit margin as an indicator of the quality of company management

- Net profit margins are important to investors and executives

Net Profit Margin Example

Here is a quick hypothetical example that you can use to calculate your company’s net profit margin.

Assumptions: Ardent|Partners sold 1,000,000 widgets for $10 each (revenue therefore equals $10,000,000), with a cost of goods sold of $5 each (COGS = $5,000,000). It had $2,500,000 in operating expenses, paid $500,000 in interest expense, and paid $1,000,000 in income taxes.

Net Profit = Revenue – COGS – Operating Expenses – Interest – Taxes

Net Profit = $10MM – $5MM – $2.5MM – $.5MM – $1MM

Net Profit = $1MM

Net Profit Margin = Net Profit divided by Revenue or $1MM divided by $10MM or 10%

So, Ardent|Partners has a 10% net profit margin.

As our example shows, Ardent|Partners had to earn $10 million in revenue to generate a net profit of $1 million.

Procurement Leverage (Why this is important)

As a collective, we’ve made great strides over the past decade, but the typical business function priority list still puts procurement closer to the bottom of the list than to the top. Today’s discussion is an argument to help Chief Procurement Officers push their departments up that list. Consider the level of effort that Ardent|Partners (or your company) invests in its business to generate its revenue – think of the production processes, the sales and marketing efforts, the service delivery process, all of the outside consultants, and on and on… – it really does take money (i.e. costs) to make money.

In Ardent|Partners’s case, we multiply total revenue ($10MM) by the net profit margin (10%) to get the net profit ($1MM). Now consider the relatively small investment that Ardent|Partners’ (or your) procurement department needs to save an equivalent amount. Ardent|Partners can invest in staff, spend analysis, and eSourcing to identify and negotiate the savings and then invest in an eProcurement solution and set a strong compliance policy to keep the savings. Let’s not get caught up in how the savings is accounted, but instead focus on the calculation that equates a savings number to actual revenue. How much revenue is needed to earn $X in net profit? What level of effort and investment does it take for your procurement department to save $X?

You can then take it a step further as Carol Danoff, Vice President, Global Procurement at Mattel (and “friend of the site”) did in her days at Colgate-Palmolive and equate procurement savings to a total number of toothpaste tubes sold.

I’ll say it again – the leverage in profitability from a small investment in procurement is extraordinary and it warrants executive engagement.

On Monday, I’ll conclude the discussion and provide some industry benchmarks on net profit margins.

Please reply below with questions or comments and I’ll incorporate them into the next article too.

Tagged in: Chief Procurement Officer, CPO, Finance, Performance, Strategy